I hope you’ve all had a productive day! Today’s post is for all you self-employed folk out there. If you’ve been around here for a while you’ll know that I often write about business and self-employment because it’s a big part of my life. I even share weekly interviews with founders of awesome small businesses.

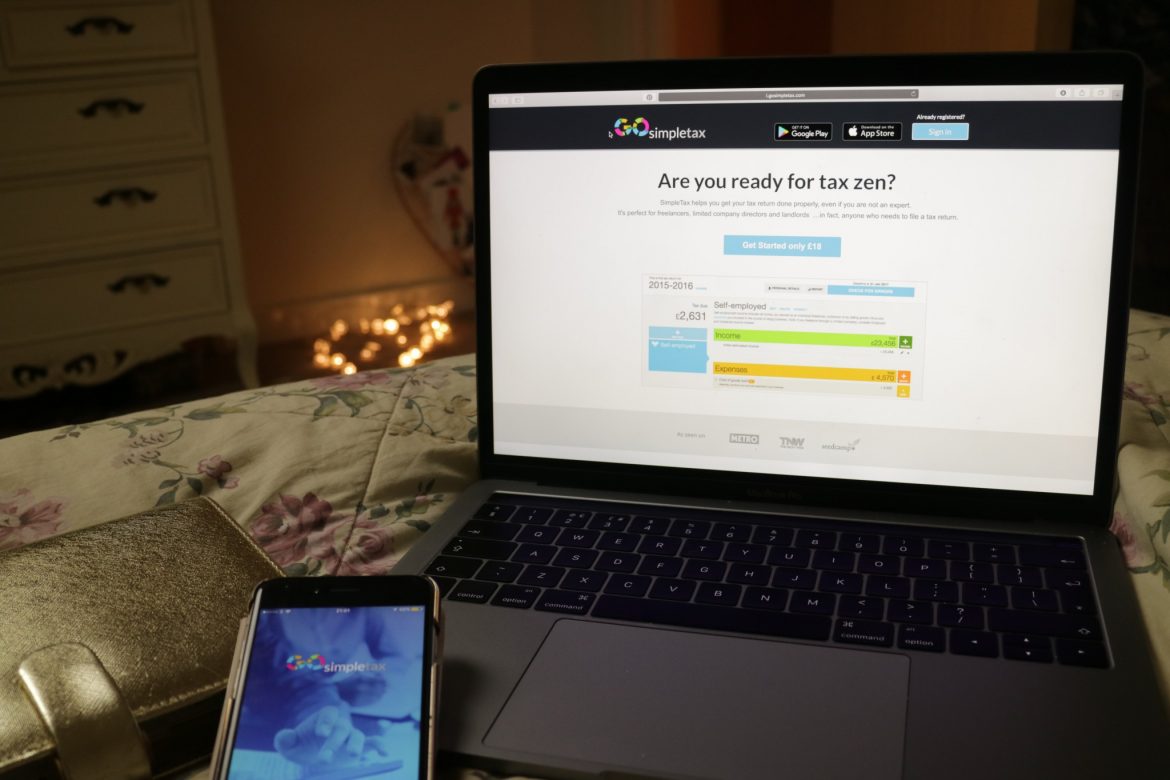

With running a small business also comes something very important and that is the topic of tax. Despite it being so important it’s a task that a lot of people worry about and often avoid. Being aware of what you’re earning and also making sure you get your taxes filed on time is essential, there’s no way around it. But, there is the chance to make it much more simple and less daunting. That’s where Go SimpleTax comes in.

When I first discovered Go SimpleTax I knew that I was onto a potential winner. I actually have an accountant at the moment but Phil doesn’t. Go SimpleTax kindly supplied us with a free code to check out their site and get Phil organised before 31st January 2017 (that’s the self assessment deadline, but I’m sure you knew that…right?).

It’s free to sign up and see what it’s all about and then if you want to go ahead you simply pay £18 when you want to confirm and submit your forms.

We’ve both really enjoyed the experience of using Go SimpleTax and that’s why I’m telling you about it today. P has a tendency to leave his tax return to the last minute because he hates the process of it. However, with this it’s actually very simple and straight forward. Go SimpleTax also submits your forms for you, which beats the HMRC website. Phil had a lot of issues with the site last year but has found his experience with Go SimpleTax much softer and less intimidating. I’ll report back once Phil has hit the submit button, just to confirm that it’s all gone smoothly.

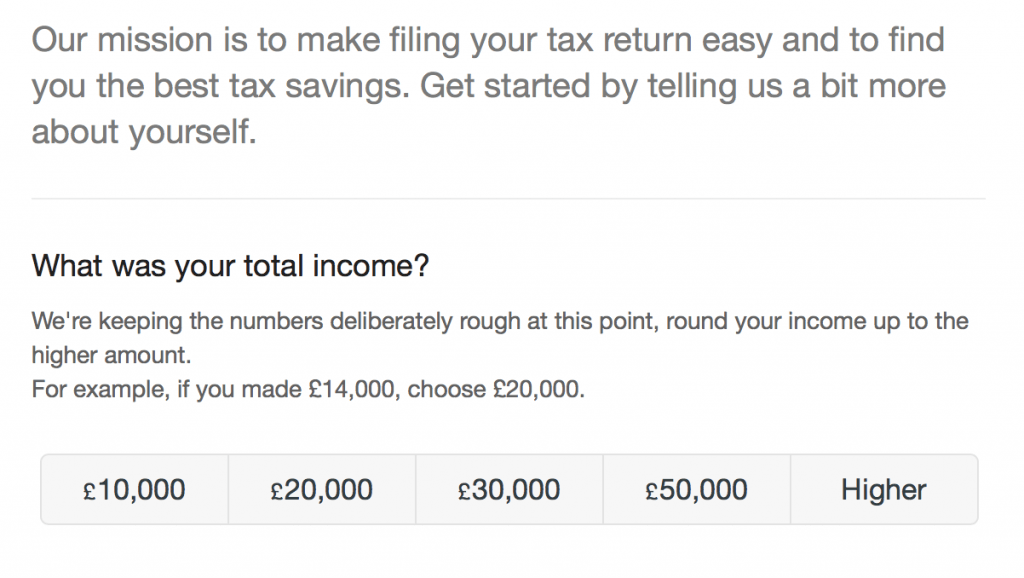

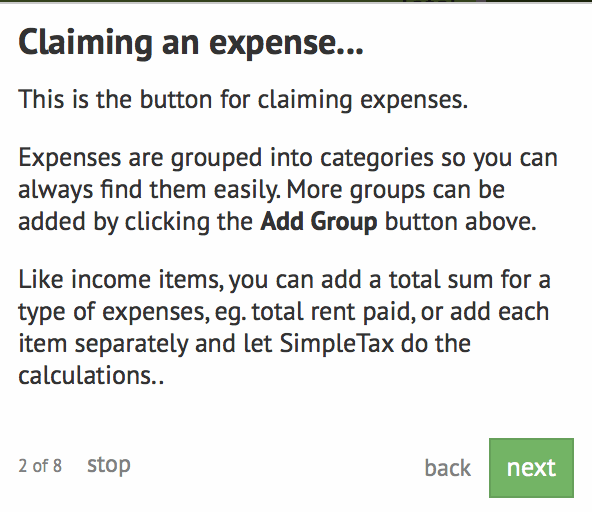

To get started you simply create an account from the website or directly in their app, input all your earnings and receipts and you’re good to go. The best part is that the site will not only help to get your earnings in order but it will nudge you in the direction of any additional savings you can make from your tax returns and the amount of tax payable.

It’s important to note that this resource is recognised by the HMRC – the people you want to keep happy.

There’s the option to switch and change to different tax years if you need to. You can also save your returns so you can easily look back at your accounts as the years go by. Throughout January they offer 7 day support which I think is really good and the rest of the year it’s 5 day support which is still good.

I love that you can use the service online or directly from your phone. Isn’t it fab how much we can do just from our phones these days?

Tax talk doesn’t sound quite so scary now does it? Honestly, it’s just so simple and easy to use. I doubt Phil and I are alone in wanting to save time, money and keep things simple when it comes to tax. If I was to change from having an accountant for any reason then I’d be very keen to use Go SimpleTax. Phil has already said it’s something he’s going to use to keep him organised and to ensure that he saves money where he can as well as paying on time.

They’ve even put together a couple of videos so if you want to hear some FAQs or learn more about the confusing acronyms around self-assessment tax they might be for you.

If you have any specific questions then drop them a message on Twitter or Facebook.

This post was in collaboration with Go SimpleTax. All opinions are my own and Phil and I have really enjoyed using the site and it looks like Phil’s going to get everything sent off in time (for a change).